Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUS Jobs & Economic Data Raise Concern, Risk Sentiment Tempered

Yesterday’s release of the delayed U.S. labor and consumption data delivered a “one-two punch” to the economic outlook, revealing a clear loss of momentum that strengthens the case for further Federal Reserve easing in 2026.

Non-Farm Payrolls Show Concerns

The delayed October–November Non-Farm Payrolls data, released following the government shutdown, painted a mixed but increasingly concerning picture of the U.S. labor market.

- The latest November Non-Farm Payrolls showed the U.S. economy added 64,000 jobs; October’s Strike-hit contraction of -105,000.

- While November jobs data beat the modest forecast of 50,000, it represents a weak recovery following October’s strike-hit contraction of -105,000.

More importantly, the unemployment rate climbed to 4.6% from 4.4%, marking its highest level in four years. While hiring has not collapsed outright, the rise in joblessness suggests labor market slack is building faster than previously expected.

This development strengthens the case for additional Fed easing in 2026, with markets increasingly pricing more cuts than the single reduction implied by the latest dot plot.

Consumer and Business Activity Lose Momentum

Signs of broader economic cooling were reinforced by weaker consumer spending and business sentiment indicators.

- October Retail Sales were flat (0.0%), missing the forecast for a 0.1% increase.

- Flash US Manufacturing PMI for December slipped to 51.8 (vs. 52.2 expected)

- Services PMI cooled to 54.1 (vs. 55.0 expected)

This suggests that elevated prices and a softer labor backdrop are beginning to restrain household demand, particularly in discretionary areas such as autos and food services.

Business surveys echoed this slowdown, although both PMI readings remain above contraction territory, the downside surprise indicates that growth momentum is fading across multiple sectors as the economy heads into the new year.

Together, the data reinforce a narrative of decelerating growth rather than resilience. As labor conditions soften and consumer spending cools, market conviction around a prolonged Fed easing cycle is strengthening—keeping pressure on the U.S. Dollar and capping risk appetite despite still-positive headline growth readings.

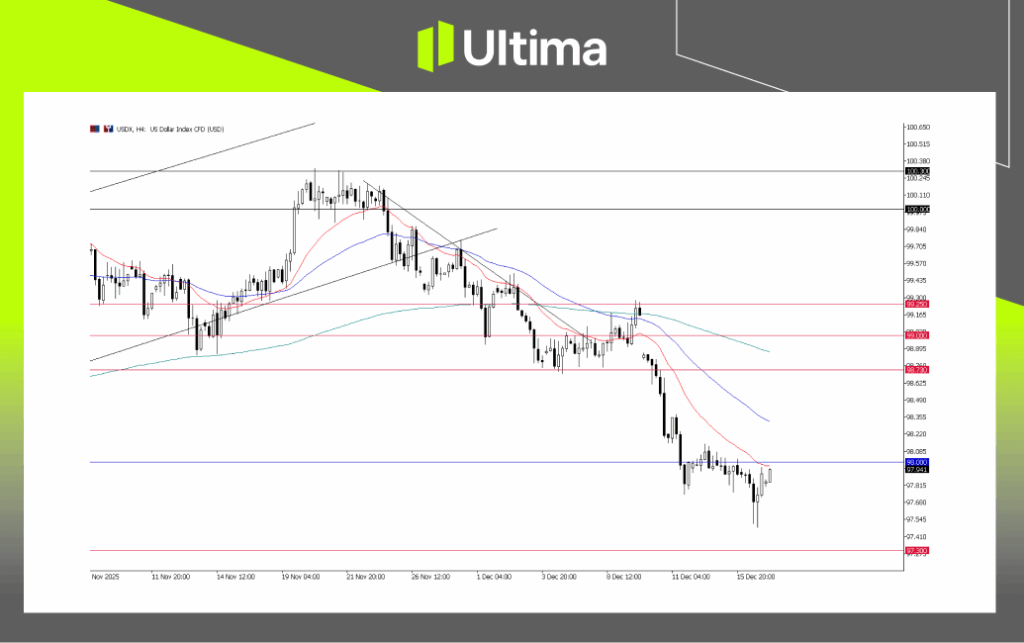

US Dollar Outlook

The US Dollar slipped below 98.00 following the post-NFP data and other key US economic releases, which collectively pointed to a softer-than-expected labor and economic environment. This has increased near-term downside pressure on the DXY.

USDX, H4 Chart | Ultima Markets MT5

Technically, the Dollar has seen some short-term rebound after the initial drop, suggesting that much of the market reaction was priced in ahead of the NFP. However, the broader outlook remains clouded.

Any rebound at this stage is likely a “sell-the-rally” opportunity, with 98.00 acting as the critical level to watch. Resistance near 98.70 will continue to cap upside momentum, keeping the Dollar under pressure unless stronger-than-expected data shifts sentiment.

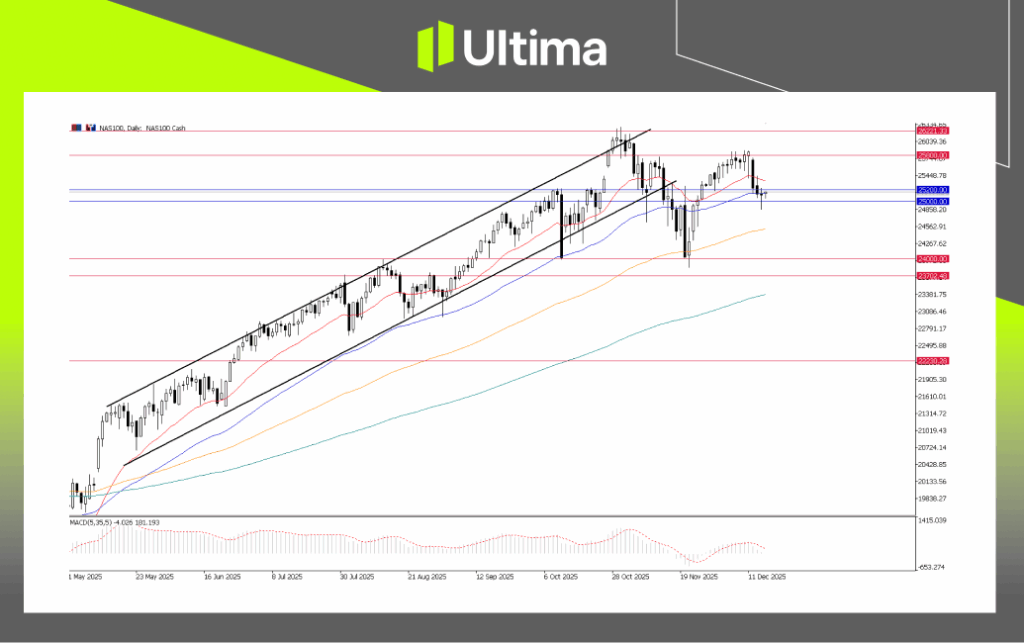

Risk Asset & US Indices Outlook

Risk sentiment has softened following the latest US economic data, which points to early signs of a slowdown. While strong corporate earnings and sector resilience continue to support the broader market, near-term upside appears limited, suggesting a consolidation phase around recent high.

Meanwhile, risk-sensitive assets, including cryptocurrencies, may face additional pressure amid the tempered sentiment.

NAS100, Daily Chart | Ultima Markets MT5

- S&P 500 (SP500): Faces resistance near record highs, with a potential double-top forming. A break below 6,775 support could accelerate consolidation, while holding this level may see the index continue sideways.

- Nasdaq 100 (NAS100): Technology remains highly sensitive to risk sentiment. Resistance near 25,800 may cap upside, keeping the index range-bound until fresh catalysts emerge.

Cryptocurrency Outlook

- Bitcoin (BTC): Extended lower below 90,000 but finding support near 86,000. A sustained hold could lead to further consolidation.

- Ethereum (ETH): 2,800–3,000 remains a critical support zone to validate a bottom.

For now, cryptocurrencies appear to have found tentative support, but tempered risk sentiment limits upside. Traders should monitor for confirmed bottoms and potential reversals to gauge the next recovery move.

What to Focus on Next: The Final Inflation Test

With the labor market clearly cooling and consumer demand stalling, attention now turns to Thursday’s US Consumer Price Index (CPI) release—the final piece of the economic puzzle. A soft inflation print would cement expectations for an aggressive Fed easing cycle in 2026, likely pushing the US Dollar below key support levels, boosting Gold, and potentially stabilizing equities.

Conversely, a surprise upside beat would signal stagflation (weak growth + high prices), complicating the Fed’s path, triggering heightened volatility, a temporary Dollar rebound, and pressure on risk assets. This release will ultimately decide whether markets close the week in “recession fear” mode or celebrating a “Fed pivot.”

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server